Car Insurance in NYC: Realistic Estimates Without Sharing Personal Details

Car insurance in NYC can swing widely by ZIP code, neighborhood, and where your car is garaged. Many “car insurance NYC” pages either use broad averages or force you into long forms before showing anything useful.

Use the car insurance calculator NYC below to get a realistic annual estimate based on NYC-specific territory data — without entering your name, email, phone number, or credit score.

Enter your ZIP, then expand “Match your situation” to adjust the few factors that actually move premiums in NYC.

No personal info required.

New York City Car Insurance Estimate

ZIP-based · NYC + Nassau + Westchester · estimate only (not a quote)

Why Car Insurance in NYC Varies So Much

- ZIP / territory pricing: NYC is priced by territory-style geography; two ZIPs in the same borough can differ.

- Where the car is kept: Garaging and parking risk can move estimates meaningfully.

- Underwriting drivers: Age range and coverage continuity can shift real premiums (even with the same ZIP).

- Coverage & deductible: Limits and deductible choices change the floor and ceiling.

How This Car Insurance NYC Calculator Works (In Plain English)

This is an estimate (not an insurance quote). It starts from a standard driver profile and adjusts using:

- NYC territory multipliers (ZIP-level geography)

- Coverage level (liability limits, deductible, add-ons)

- Match-your-situation controls (multi-car, mileage, age band, currently insured/lapse)

The goal is simple: give you a realistic starting point for car insurance in NYC without forcing personal data entry.

No Personal Info Needed

You don’t need to enter your name, email, phone number, credit score, or SSN to use this tool. Many large sites collect those details because they’re built to generate sales leads or real-time quotes.

This tool is designed for research and planning:

- Compare ZIP codes or neighborhoods

- See how multi-car and mileage shift estimates

- Understand how “currently insured vs lapse” changes underwriting assumptions

Important: Is This a Quote?

No. This is an estimate, not a quote. Actual premiums depend on the insurer, driving record, vehicle details, discounts, and underwriting. The calculator is designed to be realistic for NYC by using territory-based geography and the key factors that consistently move rates.

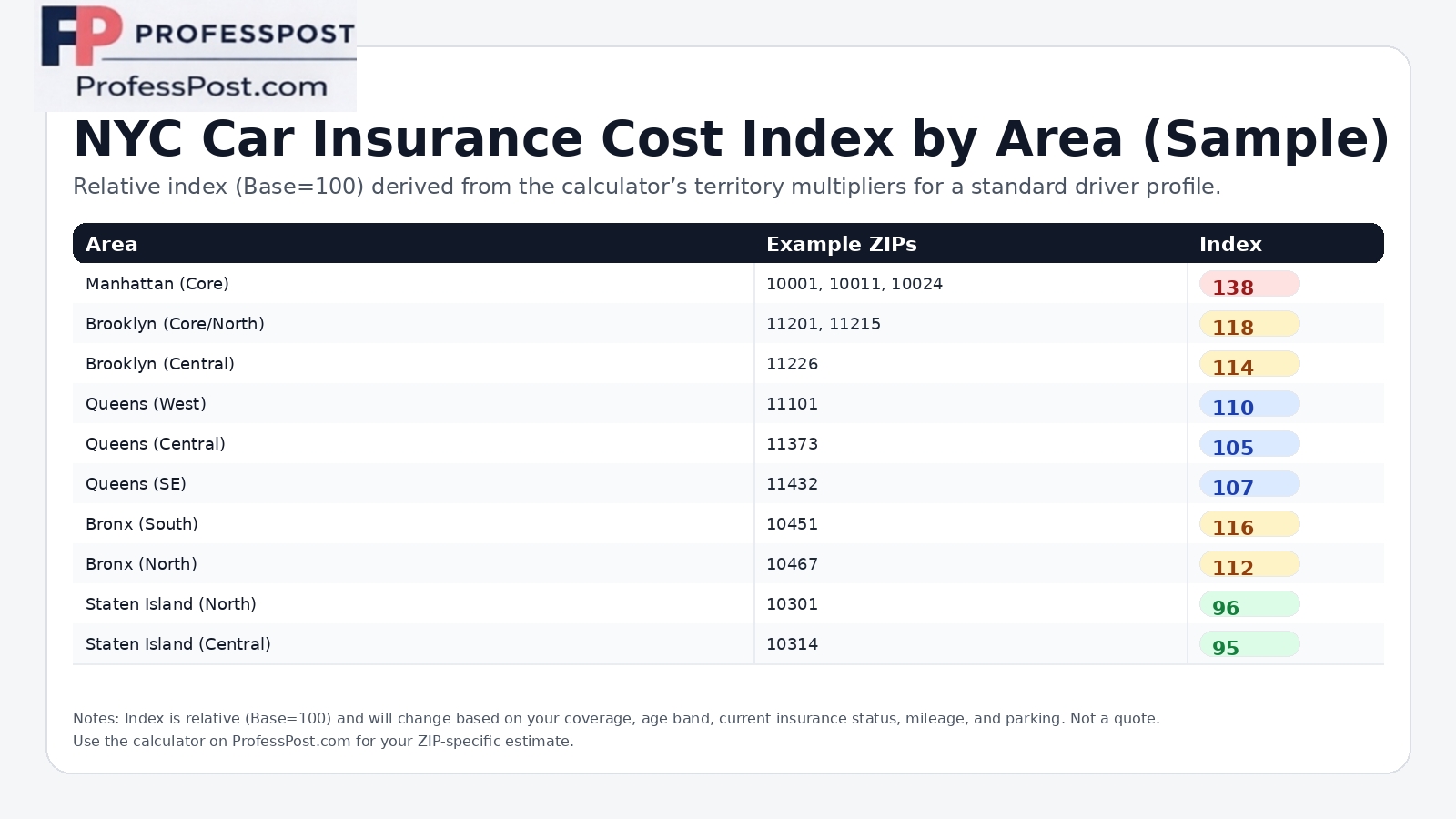

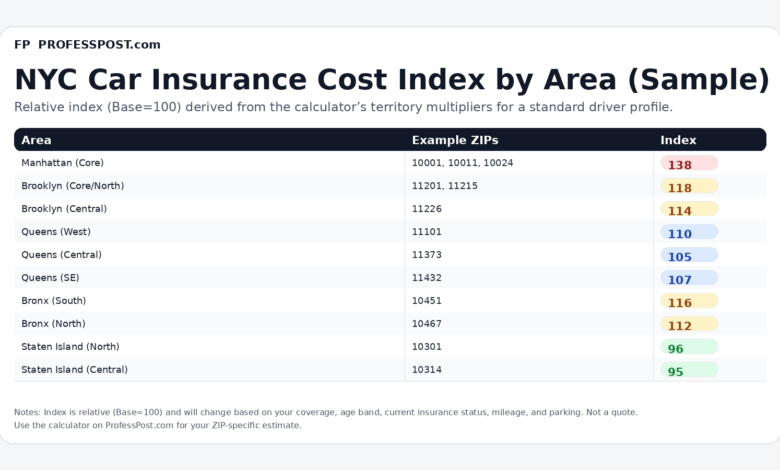

NYC Area Cost Index (Relative)

Below is a simple relative cost index showing how geography can move estimates across NYC and nearby metro counties.

This is not a price list — it’s a ZIP/territory-based index (Base=100) that helps you compare areas without misleading “fake exact” dollar numbers.

| Area | Example ZIPs | Territory (sample) | Cost Index (Base=100) |

|---|---|---|---|

| Manhattan (Core) | 10001, 10011, 10024 | NYC-M01–M03 | 138 |

| Brooklyn (Core/North) | 11201, 11215 | NYC-BK01–BK02 | 118 |

| Brooklyn (Central) | 11226 | NYC-BK03 | 114 |

| Queens (West) | 11101 | NYC-QN01 | 110 |

| Queens (Central) | 11373 | NYC-QN02 | 105 |

| Bronx (South) | 10451 | NYC-BX01 | 116 |

| Staten Island (Central) | 10314 | NYC-SI02 | 95 |

| Nassau County (West) | 11530 | NYC-NA01 | 99 |

| Westchester (SW) | 10701 | NYC-WC02 | 106 |

How to read this: Index values are relative (Base=100). Your actual estimate will change based on coverage, deductible, age band, current insurance status, mileage, and parking/garaging assumptions.