Earning $400K? You May Still Be Middle-Class in These U.S. Cities

Earning $400,000 a year might sound wealthy—but in major U.S. metro areas, that income often feels solidly middle-class. Between taxes, housing, childcare, and high living costs, many high earners are just getting by.

Key Takeaways ;

- A $400K salary is in the top 2% nationally, but much less impactful in high-cost cities.

- In cities like San Francisco, NYC, Boston, or Seattle, $400K doesn’t guarantee a luxury lifestyle.

- Taxes, housing, and childcare can eat up more than 75% of a $400K income.

- Even high earners may struggle to save or feel pressure to “keep up” in elite communities.

In most parts of America, a $400,000 annual household income is a symbol of financial success. It’s five times higher than the national median income and places a family in the top 2% of earners nationwide. But in some U.S. cities, particularly in coastal metros with soaring living costs, families making $400K may find themselves living paycheck to paycheck, struggling to save, and still feeling… middle-class.

It’s a paradox of modern urban life: How can earning nearly half a million dollars still feel like it’s not enough?

The Psychology of “Rich”

Before diving into the numbers, it’s important to understand the emotional side of income perception. Studies show that relative wealth matters more than absolute wealth. In other words: “If everyone in your neighborhood earns $1M a year, your $400K doesn’t feel so powerful.”.

This phenomenon, called “relative deprivation,” is rampant in affluent cities like San Francisco, New York, and Boston, where tech moguls, financiers, and dual-income lawyers or doctors set the local standard of living sky-high.

Depending on where you live, taxes can eat up 35–45% of your income. State income tax, federal brackets, payroll taxes, and deductions can easily leave you with just $220K–$260K in take-home pay.

High earners are taxed more—much more. At $400K, a family will lose between 35% and 45% of their income to taxes depending on the state.

- Federal income tax: ~$100,000–$110,000

- FICA (Social Security + Medicare): ~$17,000

- State income tax (in NY, CA, NJ, MA, etc.): $15,000–$45,000

- Effective tax burden: $140,000–$180,000+

In high-tax states, nearly half your income disappears before you ever see it.

Median home prices in elite cities exceed $1 million. Even with $400K of income, a modest home could mean a $7,000–$9,000 monthly mortgage.

Childcare & Private Schooling Costs Rival a Second Mortgage

- Daycare or nanny: $3,000–$5,000/month

- Private school tuition: $30,000–$50,000/year per child

For dual-income professionals with children, $60K–$100K per year can go toward care and education alone.

Social Pressure and “Lifestyle Creep”

In high-income cities, it’s easy to fall into “lifestyle inflation”. Your peers take expensive vacations, send their kids to elite schools, and hire personal chefs or tutors.

You might be:

- Leasing a luxury SUV (because everyone else is)

- Paying $4,500/month for a 2BR apartment (because it’s “normal”)

- Donating to school fundraisers or club sports (because of social circles)

Income Tier Chart (Where $400K Lands)

As shown above, $400K falls between upper-middle class and high income, but it’s a far cry from ultra-wealthy in cities where basic needs demand premium prices.

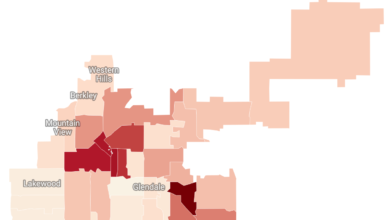

20 Cities Where $400K Feels Middle-Class

Here are the top cities where families earning $400,000 per year might still feel average, not affluent:

The American Dream used to be clear: work hard, earn a six-figure salary, buy a home, live comfortably. But in today’s economy, $400K doesn’t buy the lifestyle it once did, especially in elite urban markets. You may have a great career—but that doesn’t mean you’re immune to budget stress.

As we redefine what it means to be “middle-class,” income needs to be viewed in context of cost of living—not just in raw numbers.