Is It a Good Idea To Buy an Electric Car With a $50,000 Yearly Income?

The electric vehicle revolution is on the rise, yet in America, gasoline-powered cars still dominate. In a recent survey conducted by GOBankingRates1 with over 1,000 adults, the majority did not purchase a vehicle in the past year. However, among the 35% who did buy vehicles, the preference leaned towards traditional fuel-powered models.

Only 8% of car buyers chose to purchase either a new or used fully electric vehicle, while 23% opted for a hybrid, and 69% went for a gas-powered car or truck. This study suggests that many buyers might have hesitated due to the perception that they couldn’t afford to buy and maintain an electric vehicle, especially when the study showed that most people saved very little or just a few hundred dollars this year.

So, is it a valid concern? The average American’s reported annual income is approximately $59,428 according to Forbes. However, when considering the impact of ultra-high salaries among the wealthiest 1%, the real-world average income tends to be closer to $50,000. The affordability of electric vehicles depends on your understanding of the true cost of ownership and your personal definition of affordability.

Electric Vehicles Triumph in Fuel Savings, Maintenance, and Tax Benefits

A $50,000 salary does not disqualify you from receiving the $7,500 federal EV tax credit, making entry-level EVs, some priced in the high $20,000s, competitive with entry-level gas cars.

However, the initial price is just one factor to consider. According to Matt Smith, deputy editor at CarGurus, it’s crucial to factor in ongoing maintenance costs over the vehicle’s lifetime. Despite the higher upfront cost of EVs, even after accounting for tax credits and state incentives, their total cost of ownership can ultimately be substantially lower.

Electricity Offers Cost Savings Over Gas, Yet Exhibits Greater Price Fluctuations

Although electricity isn’t free, charging a battery is significantly cheaper than filling a gas tank. Automotive engineer and Automotive Widget editor, Robert Luterzo, highlights the financial aspects. In the U.S., the average cost of electricity is about $0.12 per kilowatt-hour (kWh). An electric car can travel around 3.5 miles on one kWh, resulting in a cost of approximately $3.60 for a 100-mile journey.

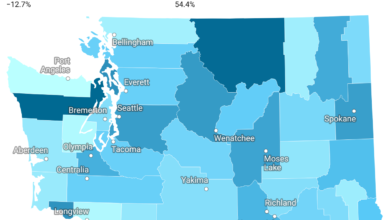

In contrast, with gas prices averaging $3.81 per gallon and the average gas vehicle achieving 25.4 miles per gallon, covering the same 100 miles would set you back $15.28. However, it’s important to note that electricity prices vary widely across regions, making budgeting for charging more challenging. For instance, if electricity were equivalent to gas prices, it would cost approximately $2.40 per gallon in Idaho, $5 in California, and $7.50 in Hawaii, as reported by CNET.

Electric Vehicles Offer Yearly Savings in Maintenance Costs

Electric vehicles (EVs) prove to be cost-effective in terms of maintenance, starting right from year one of ownership. This is largely attributed to the fact that EVs have fewer mechanical components compared to traditional internal combustion engine (ICE) vehicles. On average, it costs approximately $330 less per year to maintain an EV compared to an ICE vehicle, thanks to shared common systems like brakes and tires.

Charging at Home: Convenient Yet Initial Costs

Charging an EV at home is the most affordable and convenient option for owners. However, the installation of a home charger contributes to the higher upfront costs of EV ownership. Typically, homeowners need a 220V plug wired in their garage or outside their house, similar to an electric dryer. Installation costs vary by location, with an average starting point of around $500. Additionally, the Level 2 charger itself ranges from $400 to $800, depending on the model.

EV Depreciation: Faster Loss of Value

When it comes to depreciation, EVs tend to lose value faster compared to their gasoline counterparts. According to data from Lectron, the average EV depreciates by 52% in the first three years, while the average ICE vehicle depreciates by 39.1% over the same period. This difference in depreciation rates can impact the resale value of EVs.

Higher Insurance Costs for Electric Cars

Insurance costs for EVs are generally higher than those for traditional gas vehicles. Insurify reports an average monthly insurance cost of $357 for EVs, compared to $248 for gas vehicles. This 44% difference is attributed to the fact that while EVs have fewer collision and property damage liability claims, the incidents tend to be more severe and costly.

Affordability of EVs on a $50,000 Salary

For individuals earning an average salary of $50,000 per year, owning an EV is financially feasible, primarily due to the long-term savings on fuel and reduced maintenance. The key consideration here is the ability to manage the initial purchase price of the EV, which may require some compromises.

Determining Your Affordable Car Budget: The 10% Rule

Experts recommend using the 10% rule to determine how much car you can afford based on your monthly income. For instance, someone earning $50,000 annually, which equates to approximately $4,167 per month, should allocate just over $400 to their auto loan payment.

Chevy Bolt: An Affordable EV Option

Among the available EV options, the Chevy Bolt stands out as an affordable choice for those with a $50,000 salary. Starting at $26,500, it qualifies for a $7,500 federal tax incentive, bringing the price down to below $20,000. This competitive pricing makes it comparable to other vehicles in consideration.

2024: Enhanced Tax Credits for the Chevy Bolt

In 2024, changes in tax credits make the Chevy Bolt even more appealing. The tax credit, now applicable at the time of purchase, can significantly reduce the cost of the Bolt, making it a practical choice for budget-conscious buyers.

Footnotes