How Much Passive Income You Can Earn from $500K, $1M, and $2M in Investments (2025 Breakdown)

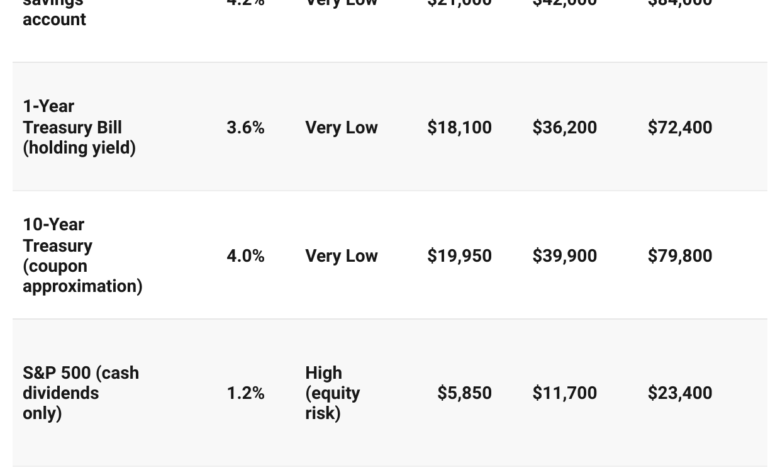

Here’s how much passive income you can earn from $500K, $1M, and $2M in 2025 — including real yields from savings, Treasuries, bonds, REITs, and stocks, plus sample portfolio strategies.

In 2025, rising interest rates and changing yields have reshaped the passive-income landscape. Whether you’re sitting on $500,000, $1 million, or $2 million, the question every investor asks is the same: How much real income can this portfolio generate — safely?

Below, we break down the annual and monthly income potential from major investment types using October 2025 market yields.

Sample Portfolio Strategies

If you’re deciding how to allocate your investments for passive income, here are three example portfolio approaches based on different risk appetites:

1. Conservative Strategy

A conservative investor might allocate around 60% to Treasuries, 30% to high-yield savings, and 10% to REITs. This portfolio would produce an average yield of roughly 3.8%, generating about $38,000 per year on a $1 million portfolio. The tradeoff is safety over return — ideal for investors prioritizing stability and principal protection.

2. Balanced Income Strategy

For those comfortable taking moderate risk, a balanced portfolio could include 40% bonds, 30% REITs, 20% dividend-paying stocks, and 10% cash or savings. This mix averages around a 4.5% yield, translating to about $45,000 per year on $1 million invested. It offers a healthy blend of income, diversification, and moderate volatility.

3. Aggressive Yield Strategy

Income-focused investors chasing higher returns might choose 40% REITs, 40% high-yield corporate bonds, and 20% equities. This allocation targets an estimated 5.8% yield, producing approximately $58,000 annually on a $1 million portfolio. It comes with higher exposure to market and credit risks, but also the potential for stronger income growth over time.

Each of these strategies can be tailored based on personal goals, tax considerations, and risk tolerance. Rebalancing annually helps maintain your target income level and risk exposure as market conditions shift.