New Hampshire Property Tax Rates 2025 by County

In New Hampshire, the median annual property tax is $4,636 for a home with a median value of $249,700.

In New Hampshire, the median annual property tax is $4,636 for a home with a median value of $249,700. On average, counties in the state collect about 1.86% of a property’s assessed fair market value in property taxes each year.

New Hampshire ranks among the states with the highest property tax rates in the U.S., with only two states imposing higher taxes.

With a median household income of $73,159, the typical property tax payment represents approximately 6.34% of residents’ annual income. This places New Hampshire 2nd among all 50 states for property taxes as a percentage of median income.

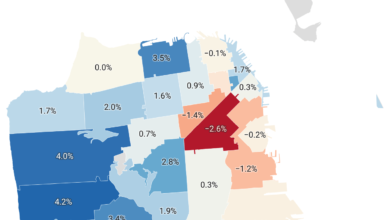

Property tax rates in New Hampshire vary by county. Rockingham County has the highest property taxes in the state, with an average annual tax of $5,344.00, which is 1.74% of the median home value. In contrast, Carroll County has the lowest property taxes, averaging $2,582.00 per year, or 1.07% of the median home value.

Hillsborough County Property Tax Rate 2025

In Hillsborough County, New Hampshire, the median annual property tax is $4,839 for a home with a median value of $269,900. On average, the county charges 1.79% of a property’s assessed market value in property taxes.

Hillsborough County ranks 36th among 3,143 counties in the United States for its median property taxes, which are among the highest nationwide. On average, residents of Hillsborough County pay property taxes that amount to approximately 5.64% of their annual income, placing the county 50th in terms of property taxes as a percentage of median income across all counties.