Retirement Confidence Among Americans Has Hit An All-Time Low

According to a recent research released this week, there was a significant decline in the percentage of Americans who believe they will be financially prepared for a comfortable retirement.

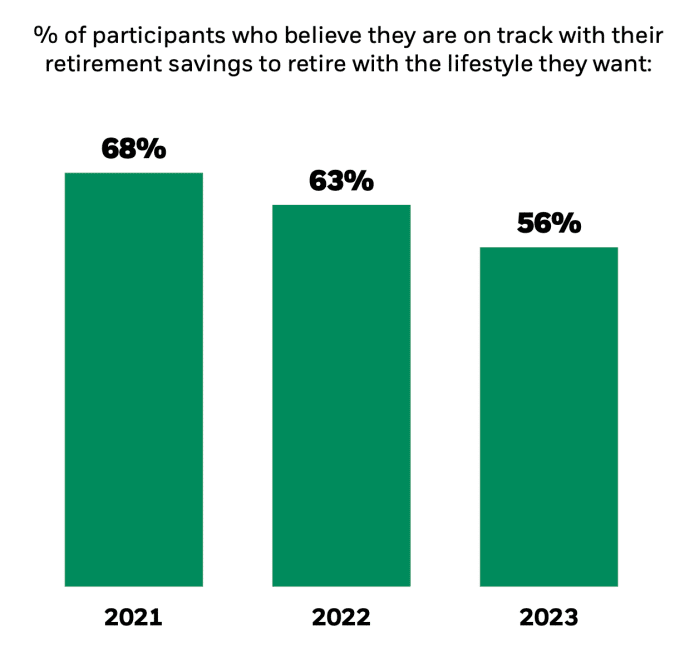

According to BlackRock’s findings, the percentage of people feeling on track for retirement has decreased from 68% in 2021 to 63% in 2022 and further to 56%. Gen Z experienced the largest decline in confidence and expressed a higher likelihood of selling investments during market downturns compared to baby boomers.

Anne Ackerley, head of BlackRock’s retirement group, noted that this decline in confidence is driven by market volatility and inflation, which have raised concerns about financial security both in the present and in the future. She shared these insights with Yahoo Finance Live.

She stated that their survey on retirement has shown the lowest confidence levels in eight years, primarily due to the challenging market environment experienced last year, with both stocks and bonds declining. Despite these concerns, workers maintained their savings course, refraining from reducing contributions.

They adjusted their spending habits instead, foregoing vacations and large purchases to keep contributing. However, there’s a concern that 60% of Gen Zers might consider selling investments during market downturns, while only 20% of boomers shared that sentiment. Ackerley emphasized the importance of not selling but rather riding through market fluctuations and continuing to contribute regularly.

Some boomers are contemplating delaying retirement to recover financially amidst market volatility, though it may not be feasible for everyone.

A another study by the nonprofit Transamerica Center for Retirement Studies revealed that a significant number of workers view working as an essential part of their retirement plans. According to the survey of 5,725 employees, 55% of workers intend to work after they retire. Among them, nearly 20% plan to work full time, while over a third plan to take on part-time jobs. Surprisingly, 15% of all workers expect their primary retirement income to come from working.

Another effective approach to increase retirement income is to delay claiming Social Security benefits, resulting in higher payments. For example, if a worker retires as early as 62 (before reaching full retirement age), they might receive up to 30% less in monthly benefits due to the extended duration of receiving benefits. This reduction is typically permanent. However, if the worker waits until age 70 to claim, they can earn delayed retirement credits, potentially adding up to 8% extra for each year between full retirement age and 70 when the credits stop accruing.

Though there are strategies to get back on track, it’s crucial to acknowledge that the current period poses challenges for many people in terms of retirement savings.