San Francisco’s historically high vacancy rate begins to stabilize

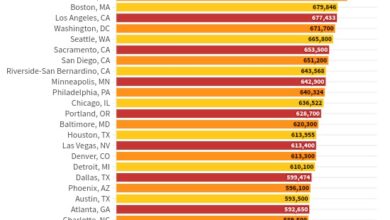

San Francisco’s office market is emptier than ever. According to new data from the real estate firm CBRE, the vacancy rate rose from 36.6% last quarter to a record 37% in the second quarter of 2024—the highest rate among major markets in the country.

According to CBRE experts, the market is starting to stabilize, as shown by the modest 0.4% increase in office vacancy rates between the two recent quarters. This is a significant contrast to 2023, when the office vacancy rate surged by 6.8% from 24.8% in the first quarter to 31.6% in the second quarter.

“Signs of stabilization in the office market are emerging, with a significant slowdown in the amount of vacant space entering the market,” said Colin Yasukochi, CBRE’s executive director of Tech Insights Center.

However, the office market has faced challenges for years, with vacancy rates steadily increasing each quarter.

Yasukochi noted that despite the ongoing climb in vacancy rates, tenant demand has risen to 6.9 million square feet, nearing the 2019 average of 7 million square feet. This increase is driven by discounted rents and other concessions, leading to more leases being completed this year compared to the previous quarter, according to CBRE’s report.

“The amount of space leased by tenants has increased by about 25% in the first half of this year compared to last year,” Yasukochi said. “We expect more companies to acquire office space for their employees this year than they did last year.”

CBRE reports that AI companies are the main drivers of demand. The largest lease this past quarter was secured by Scale AI, followed by the city of San Francisco, HR management firm Rippling, and global law firms Orrick and Jones Day.

Average rents dropped by about 30 cents to $68.25 compared to the previous quarter.

Yasukochi noted that while the city is still far from achieving net positive office absorption, there is strong optimism about AI companies as a catalyst for future growth, given San Francisco’s leadership in artificial intelligence.

CBRE’s report also indicated that San Francisco remains significantly oversupplied.

Experts say it will take years for the city’s vacancy rates to drop below double digits, as they were before the pandemic when office vacancy rates were considered relatively healthy.