Nearly 50% of Credit Card Users are in Debt, Facing Months or Even Years to Pay it Off

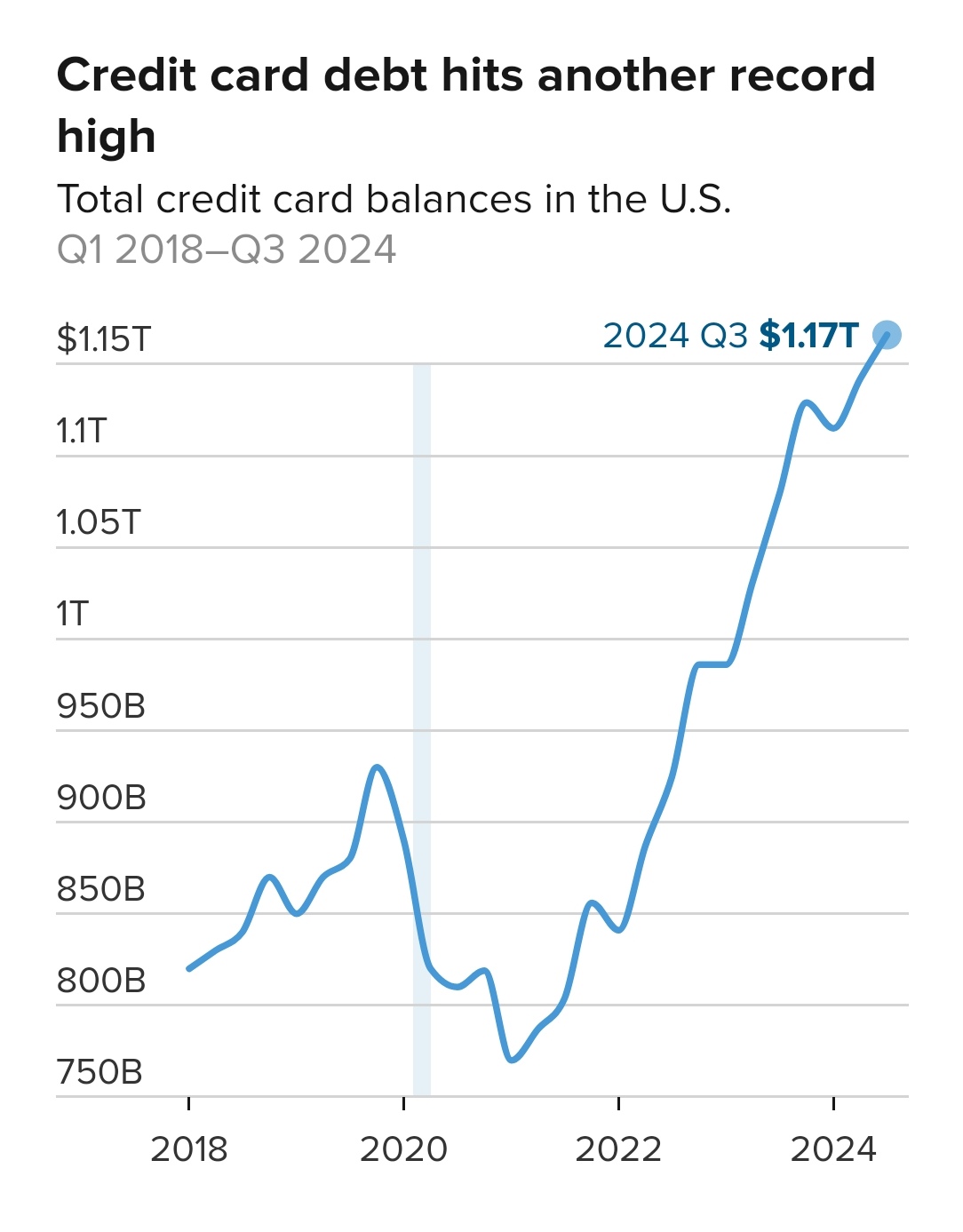

Nearly half of credit cardholders, 48%, carry a balance from month to month, according to a recent report. While unexpected emergency expenses are the most common reason, rising costs and overspending also contribute. Many borrowers admit it may take years to pay off their debt.

Nearly half of American credit card holders—48%—are starting 2025 with ongoing debt, according to a recent Bankrate report. This marks an increase from 44% at the beginning of 2024. Among those with balances, 53% have been carrying their debt for a year or longer.

Approximately 47% of borrowers report carrying a balance due to unexpected or emergency expenses, such as medical bills or car and home repairs. Others attribute their debt to rising day-to-day costs and general overspending.

“High inflation and elevated interest rates have been a challenging combination. While the worst may be over, the lasting effects remain significant,” said Ted Rossman, senior industry analyst at Bankrate, in a statement.

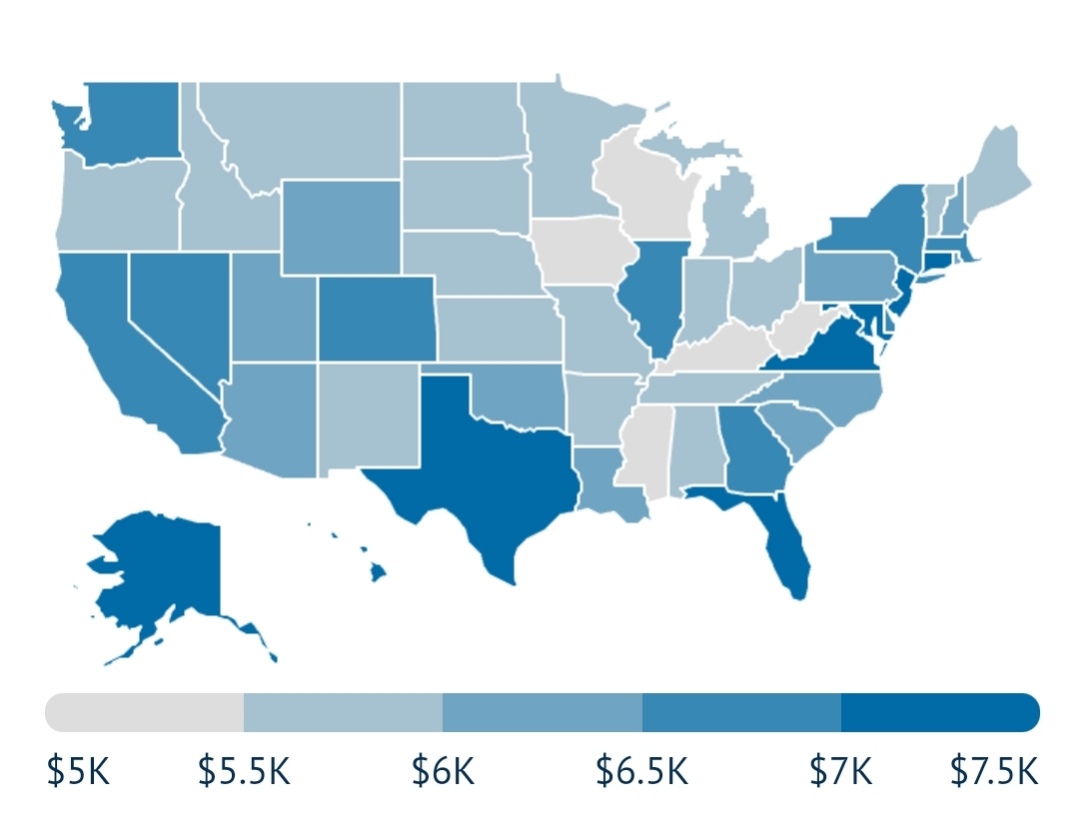

Americans’ credit card debtcredit card debt has steadily increased over time. According to TransUnion’s latest credit industry insights report for the third quarter of 2024, the average credit card balance per consumer is now $6,380, a 4.8% increase compared to the previous year.

For example, with annual percentage rates slightly above 20%, making only the minimum payments on an average balance of $6,380 would take over 18 years to pay off. During that time, you’d end up paying more than $9,344 in interest alone, as calculated by Rossma n.

A report by LendingTree revealed that 36% of consumers increased their debt during the holiday season. Among those with debt, 21% anticipate it will take five months or more to pay it off. Similarly, a WalletHub survey found that 24% of Americans expect to need over six months to clear their holiday shopping debt.

Most respondents attributed their overspending to inflation, which drove them to exceed their initial budgets. “Many people need months to repay holiday bills after overspending,” said John Kiernan, WalletHub’s editor.