The Real Value of $100 in America’s Largest Metro Areas (2025)

A $100 bill does not buy the same life everywhere.

In some U.S. cities, it barely covers a grocery run. In others, it still stretches surprisingly far. The difference isn’t about wages alone — it’s about regional price levels, housing costs, taxes, and everyday expenses that quietly shape how “rich” or “poor” a salary actually feels.

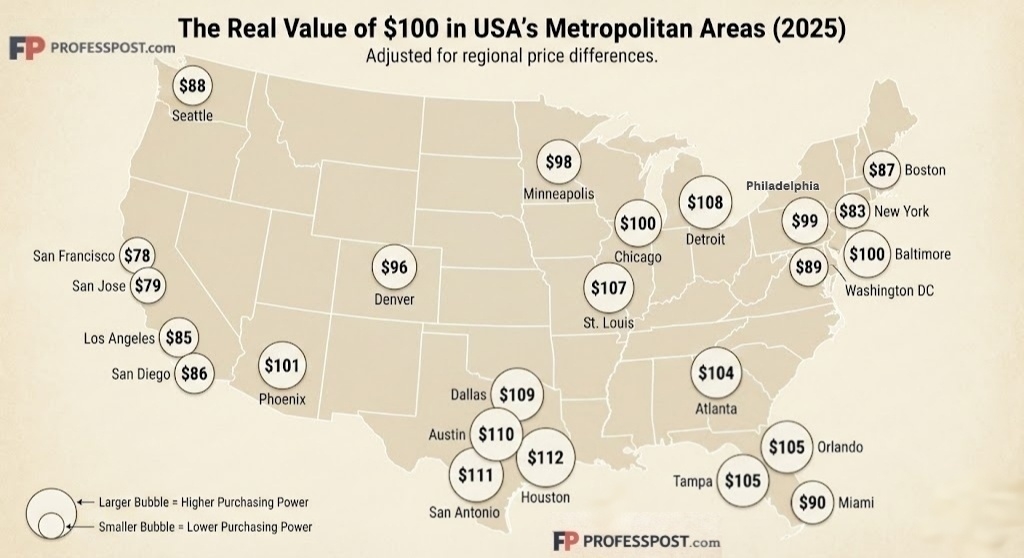

Using the latest BEA Regional Price Parities (RPP) data, adjusted to 2025 dollars, we calculated what $100 is really worth across America’s 25 largest metropolitan areas.

The results explain why a six-figure salary can feel tight in California — and comfortable in Texas.

What Does “The Real Value of $100” Mean?

The concept is simple: $100 = national average purchasing power, Below $100 → higher cost of living (money buys less) and Above $100 → lower cost of living (money buys more). So if $100 is worth $83 in a metro area, you’d need $120+ there to live like someone earning $100 nationally. If it’s worth $112, your money stretches further — even without a higher salary.

The Real Value of $100 by Metro Area (2025)

The Most Expensive Cities: Where $100 Feels Like $80

California Dominates the “Least Value” List

The five lowest-value metros are all coastal powerhouses — and all painfully expensive. In San Francisco and San Jose, $100 barely functions like $78–$79 nationally. Housing costs alone do most of the damage, followed by taxes, utilities, and services priced for top-tier earners. Even high salaries struggle to keep up — which is why so many tech workers feel wealthier after moving away from Silicon Valley. New York City isn’t far behind. At $83, everyday life quietly taxes your paycheck long before income taxes do.

The Middle Ground: Where $100 Actually Feels Normal

Cities like Chicago, Philadelphia, Minneapolis, and Baltimore cluster right around the national average. These metros offer:

- Big-city job markets

- Diverse housing stock

- More stable rent-to-income ratios

- For many professionals, this is the sweet spot: urban opportunity without coastal pricing.

Where $100 Goes the Furthest : Texas Quietly Wins the Value War

The biggest surprise isn’t which city ranks last — it’s which ones rank first. Texas metros dominate the top of the list:

- Houston ($112)

- San Antonio ($111)

- Austin ($110)

- Dallas ($109)

Lower housing costs, lighter tax burdens, and sprawling development mean that even as prices rise, money still stretches further than in most U.S. cities. This is why remote workers earning “New York money” often relocate to Texas — and feel instantly richer.