What Income Actually Feels Comfortable in Seattle in 2026?

Seattle salaries look high on paper — but so do Seattle expenses.

Comfortable living here isn’t about bare survival. It means paying rent without stress,

saving consistently, and maintaining flexibility in a high-cost city.

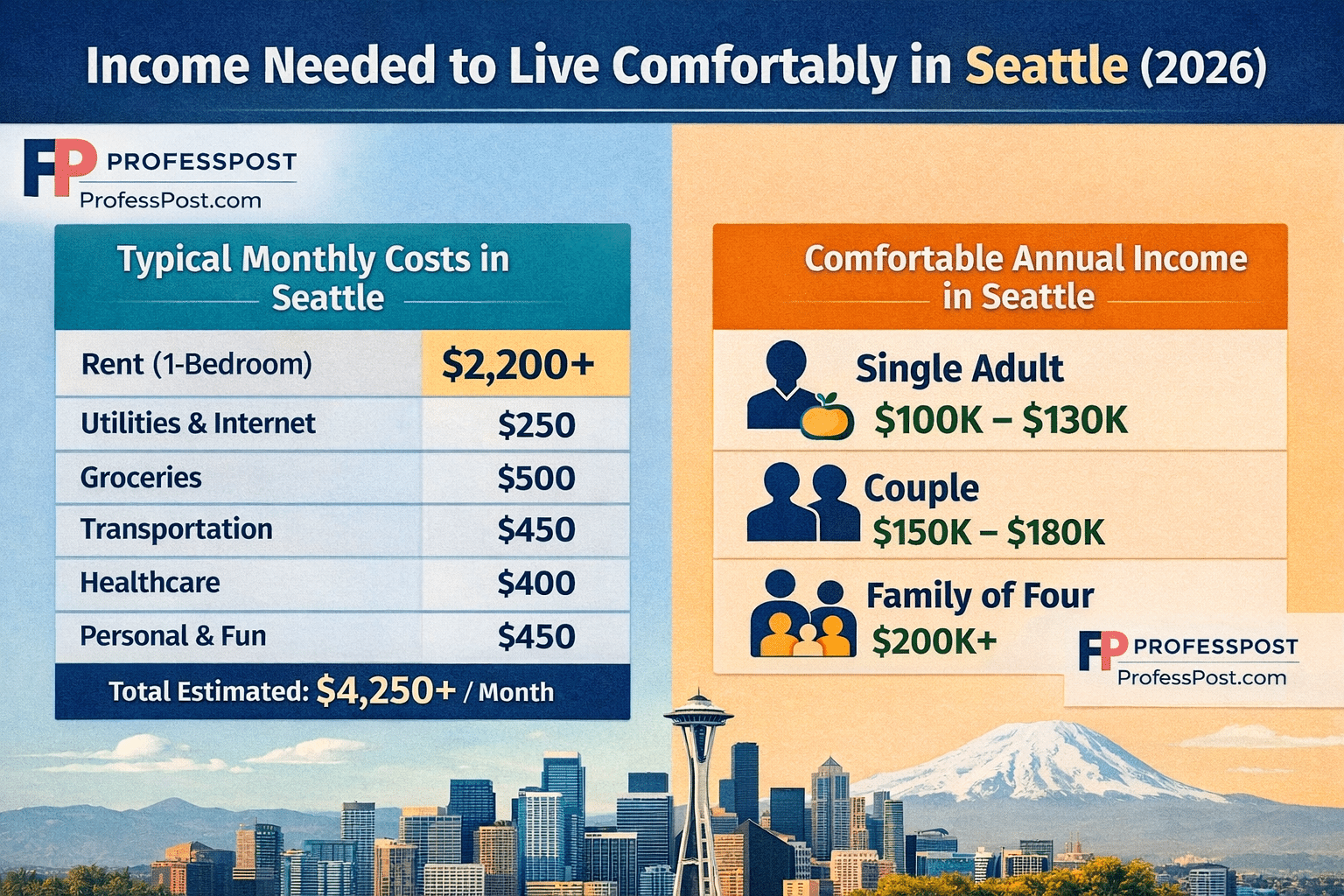

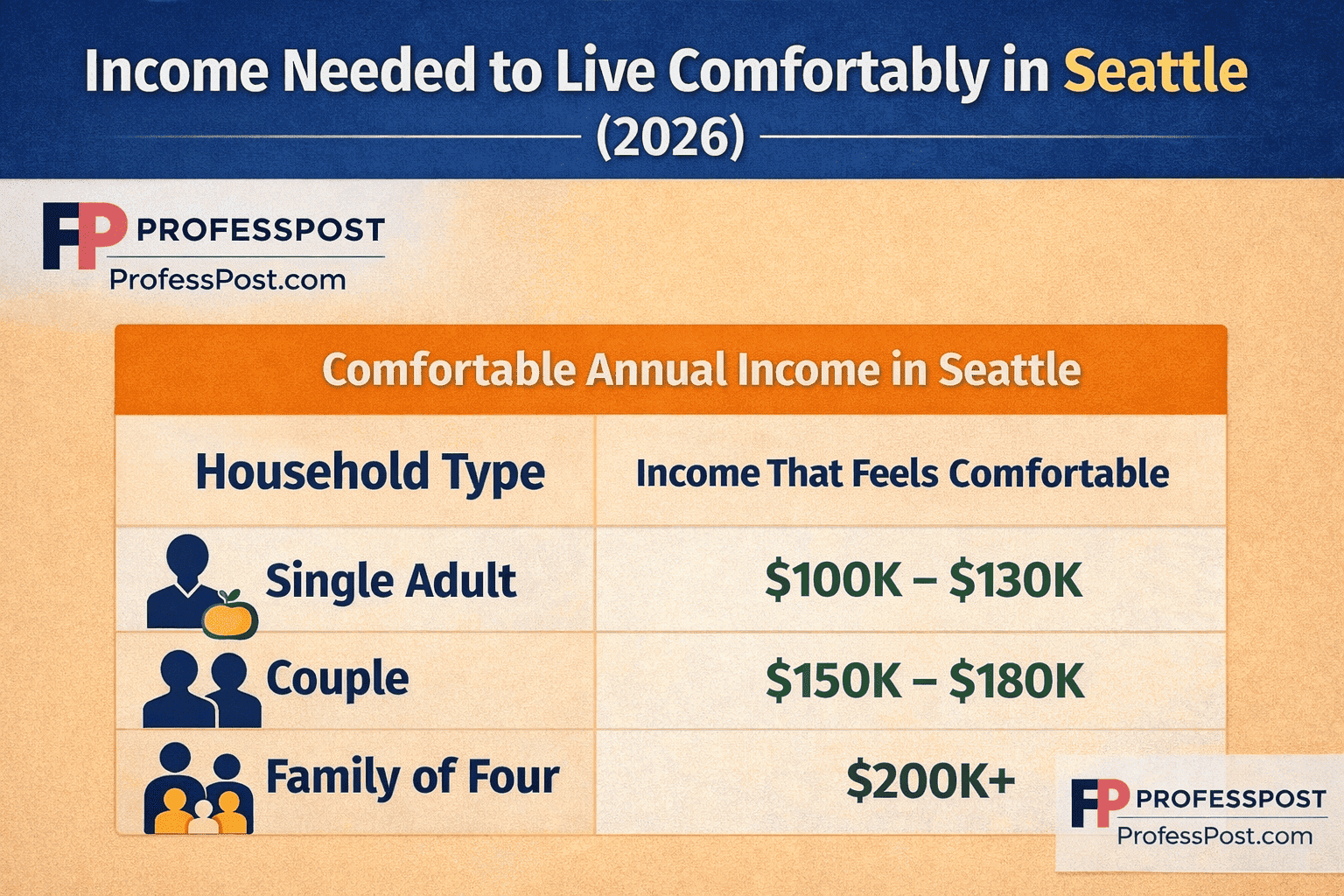

In 2026, most financial planners would place a realistic comfort range at

$100K–$130K for a single adult and roughly

$200K+ for a family household.

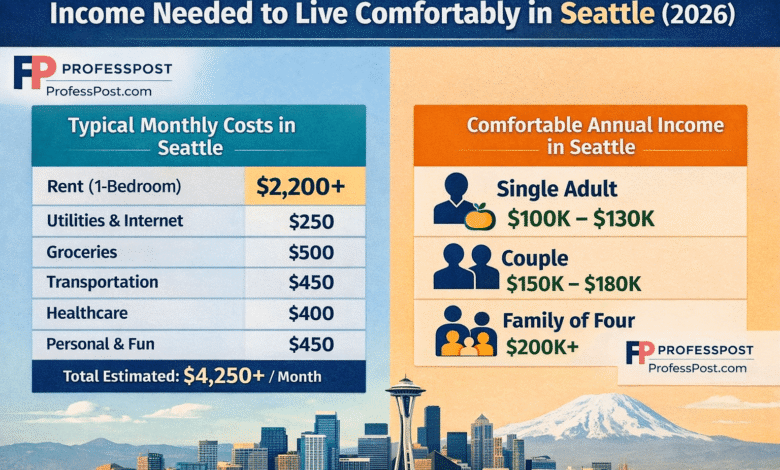

A Realistic Monthly Budget in Seattle

A typical single adult lifestyle in Seattle breaks down roughly like this:

That baseline equals roughly $51K per year just to cover essential expenses.

A comfortable salary must go well beyond that to allow savings, retirement investing,

and protection against unexpected costs.

Why Seattle’s Comfort Threshold Is Higher

- Housing dominates budgets. Rent absorbs a large share of income,

making the traditional 30% housing rule harder to maintain. - Everyday prices run above the national average.

Groceries, services, and utilities all trend higher than most U.S. cities. - Income expectations rise with the tech economy.

Higher average salaries in major industries reset what feels financially stable.

Comfortable Income Benchmarks

The Practical Takeaway

Seattle offers strong career opportunities and quality of life,

but the financial bar for comfort is higher than many people expect.

Reaching six figures isn’t about luxury here — it’s about stability.

For residents planning a move or career shift,

understanding this income threshold is key to avoiding financial strain

in one of America’s fastest-growing metro areas.

Related Seattle & Personal Finance Guides

How Wealth Really Looks in Seattle: What It Takes to Reach the Top 10%

What It Takes to Reach the Top 10% of Household Net Worth in Dallas

Richest Neighborhoods in Houston: Where Wealth Is Concentrated

How Much Net Worth You Need to Be in NYC’s Top 10% by Borough