What It Takes to Join the Top 5% of Earners in Every State

To match the average income of the top 5% of earners in the wealthiest U.S. states, you’d need to make more than $500,000 a year, according to a recent analysis by GOBankingRates.

A new study from GOBankingRates found that the average income for the highest-earning households now exceeds $500,000 a year in 12 states. The analysis was based on the most recent U.S. Census data from 2023.

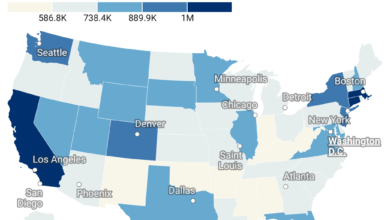

Study reveals a significant income gap in several U.S. states, particularly those with a high cost of living. In five states, the top 5% of earners make $600,000 or more annually. These states are Connecticut, where the threshold is $637,673, followed by California at $619,938, Massachusetts at $619,385, New York at $619,178, and New Jersey at $616,334.

In total, twelve states see their top 5% of earners making more than half a million dollars a year. Joining the top five are Washington ($573,110), Colorado ($535,056), Virginia ($534,776), Maryland ($522,117), Illinois ($514,347), New Hampshire ($510,730), and Hawaii ($505,977).

The income disparity is most pronounced in New York, the only state where the top 5% earn seven times more than the median household income. This gap is also substantial in 24 other states, where the top 5% make six times the median income, and in the remaining 25 states, they earn five times as much.