Experts Identify the “Magic Mortgage Rate” That Could Revive the Housing Market

According to a new survey, the average 30-year fixed-mortgage rate of 6.62% is still well above the ‘magic’ number that might spur resale turnover.

After dropping to a 16-month low of 6.11% in early September, the average 30-year fixed mortgage rate monitored by Mortgage News Daily has risen again, reaching 6.62% as of Tuesday.

This uptick is expected to slow down some of the refinancing activity that had recently picked up, as borrowers with mortgage rates of 7% or 8% were beginning to take advantage of the lower rates for some financial relief.

A recent survey conducted by John Burns Research and Consulting (JBREC) reveals that neither the 6.11% mortgage rate nor the current 6.62% rate is sufficient to encourage homeowners to sell their properties. Many are choosing to stay in their homes due to the influence of mortgage rates.

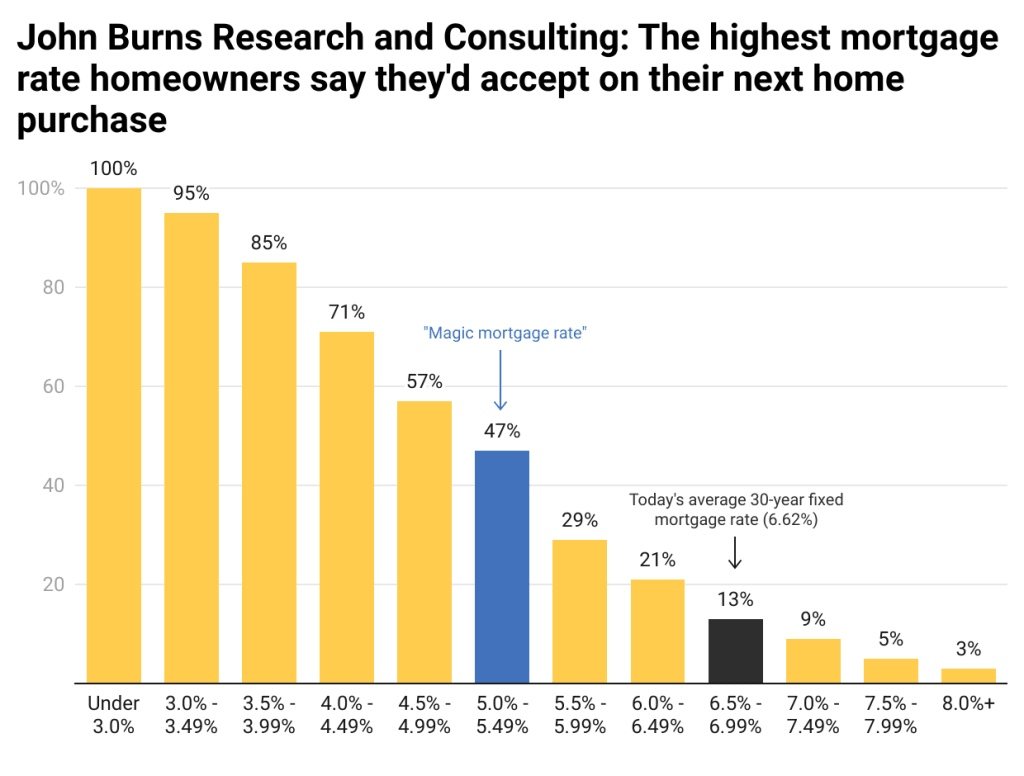

The “magic mortgage rate” that could significantly boost the housing market, currently experiencing multi-decade low resale activity, is below 5.5%, according to JBREC. The research firm has maintained this perspective for some time and reaffirmed it in its September 2024 survey.

According to a survey conducted by JBREC, only 13% of homeowners indicated they would be willing to accept a mortgage rate between 6.5% and 6.99% for their next home. In contrast, 47% expressed willingness to accept a mortgage rate in the range of 5.0% to 5.5%.