Where Realtors Earn the Most: Comparing Major U.S. Cities After Taxes and Living Costs

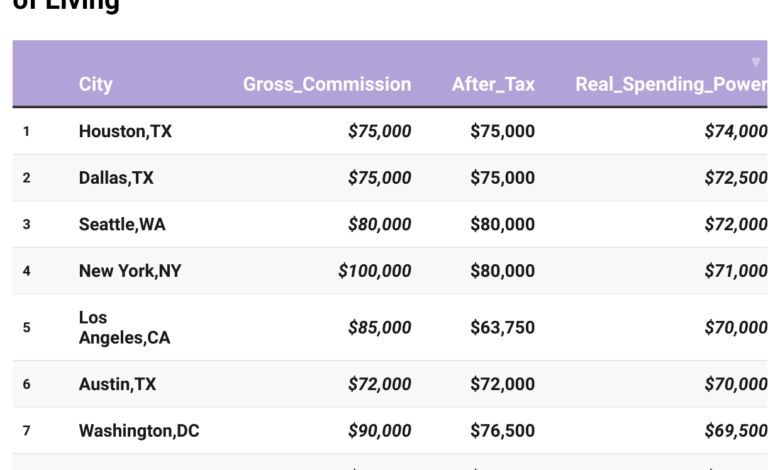

Realtors’ commissions vary widely across cities. This guide compares 30 major U.S. cities, showing gross earnings, after-tax income, and real spending power adjusted for cost of living.

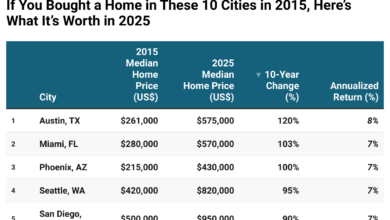

For Realtors, income isn’t a fixed salary — it’s entirely commission-based, driven by home prices, number of transactions, and local market activity.

This means a Realtor working in New York City can earn a very different income than a Realtor in Austin, Texas, even if they sell the same number of homes. However, gross commissions alone don’t tell the full story. Taxes and cost of living can significantly affect how far a Realtor’s income actually stretches.

How We Estimate Realtor Earnings

To provide a useful comparison across cities, we made a few illustrative assumptions:

- Average home price per city determines potential commissions. Higher-priced homes yield higher commission per transaction.

- Number of annual sales represents a typical Realtor’s transaction volume in that city.

- Commission rate is assumed to be 3% of the home price, split with the brokerage (1.5% per transaction for the agent).

- City and state taxes reduce the take-home amount.

- Cost-of-living adjustments account for higher living expenses in major metropolitan areas.

The resulting “Real Spending Power” shows how far a Realtor’s income can go after taxes and local costs — an essential consideration for anyone deciding where to focus their career.

Insights for Realtors

- High Commissions Don’t Always Mean High Spending Power : Cities with expensive homes produce bigger checks per sale, but taxes and living costs can offset these gains. A Realtor earning $100,000 in San Francisco might effectively have less spending power than a Realtor earning $75,000 in Texas.

- Volume Matters : Smaller homes and more frequent transactions in lower-cost markets can generate comparable or higher take-home pay than fewer, high-value transactions in expensive cities.

- Cost of Living is Critical : Even if gross commissions are identical, a Realtor’s lifestyle depends heavily on local expenses: housing, transportation, utilities, and other costs of daily living.

- Taxes are a Major Factor : States like California, New York, and New Jersey levy significant state and local income taxes, reducing net income. States with no state income tax (Texas, Florida, Washington) allow Realtors to keep more of their hard-earned commissions.

Major City Comparisons

Consider the differences between high-cost coastal cities and more affordable, fast-growing markets:

- San Francisco, CA: With a median home price above $1.3 million, commissions can be huge. However, high taxes and cost of living reduce the real value of income. A $90,000 gross commission may feel more like $63,500 after adjustments.

- New York, NY: High home prices generate substantial commissions, but state and city taxes, along with living costs, cut real spending power significantly.

- Los Angeles, CA: Similarly, large homes and expensive markets create strong gross income, but net income after taxes and living costs drops noticeably.

- Austin, TX: Lower home prices are offset by higher transaction volume and no state income tax, meaning Realtors often retain a higher percentage of their commissions.

- Miami, FL: Attractive home prices combined with no state income tax give Realtors good take-home income and solid spending power.

Midwestern cities like Chicago, Dallas, and Phoenix may offer smaller home prices, but Realtors benefit from a balance of reasonable commissions, lower taxes, and affordable living costs, creating competitive real income.